The medical spa market is predicted to reach a value of $47 billion by 2030, according to Global News Wire. Despite their increased demand, however, the most popular medspa services and procedures carry a heavy price tag that deters many would-be clients. Flexible payment solutions, such as the newly released Vagaro Pay Later, enable medspas to capitalize on their industry’s growth and sell more of their services to clients while removing the pressure on their wallets.

Vagaro Pay Later powered by Certegy is an example of the buy now, pay later payment model. It gives clients the financial flexibility to afford many big-ticket services they normally wouldn’t be able to, such as Botox, dermal filler injections, or LASIK, in four interest-free installments. This eliminates the need to lower your prices or potentially drop procedures from your service menu. The VPL Split-Pay option adds yet another layer of convenience for buyers by letting them split their payment between their credit card and Vagaro Pay Later

In these ways, you’ll effectively enable more people to prioritize their self-care and earn more money in the process.

Below, we’ll break down the benefits of buy now, pay later, and explore how Vagaro’s latest feature can grow your business.

How Does Vagaro Pay Later Work?

To answer this question, we should first define the Buy-Now, Pay-Later (BNPL) payment model.

Buy-Now, Pay-Later (BNPL)

BNPL divides a (typically large) purchase into a series of equal payments (typically four), the first of which is made at checkout. Buy now, pay later is offered by most major traditional and e-commerce retailers and used frequently in the healthcare industry. Businesses are paid in full up front and the BNPL provider carries the risk, not the seller.

BNPL use increased significantly during the pandemic, fueled by the uptick in online shopping. In 2022, BNPL payments grew at a rate of 66.5% in the U.S. alone. Wellness businesses on the Vagaro platform are poised to take advantage of this growth.

Vagaro Pay Later

Vagaro Pay Later

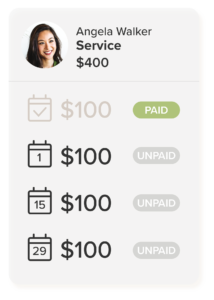

Vagaro Pay Later seamlessly integrates into the rest of your Vagaro medspa software and apps. It can be applied to any service or product you sell and works with both online and in-store purchases. When clients opt to use Vagaro Pay Later, they agree to make four interest-free payments over six weeks. This equates to one payment automatically charged every two weeks, or, around every pay day for most people.

For context, let's use the example of a $500 Botox treatment. When a qualifying client selects Vagaro Pay Later as their payment option, your business receives all the funds right away. The client pays $125 at checkout, followed by three additional $125 payments. Simple math, right? All installments are automatically withdrawn from a client’s linked bank account.

Ways Vagaro Pay Later Can Benefit Your MedSpa

The benefits of Vagaro Pay Later are obvious for clients, but what about the growth of your business?

Well...

It Helps You Sell Higher-Value Services

As we have already covered, using a BNPL service like Vagaro Pay Later enables clients to afford your higher-revenue-generating services by easing their financial burden. That means selling more:

- Botox injections

- Filler injections

- LASIK surgeries

- Deep microdermabrasions

- Expensive spa packages

- High-end product packages

Why the uptick in big sales? Having the agreed-upon amount deducted on pay day enables clients to budget accordingly for purchases that otherwise do not fit into their immediate budget.

It Adds Flexible Payment Options

Vagaro Pay Later’s Credit Card Split-Pay feature stretches payment flexibility even further, enabling clients to split payment between their credit card and VPL at checkout if needed for an even easier, more manageable payment option. This is especially useful if a transaction exceeds the VPL maximum limit of $1,500.

Payment can also be split between VPL, cash, gift card or check.

It Increases Your Reach

Offering Vagaro Pay Later can bring in scores of new customers from different demographics. Buy now, pay later is particularly popular among Millennial and Gen Z shoppers, especially because it doesn't require a hard credit check. After easy budgeting, respondents to that same survey above cited the lack of credit checks and interest-free payments as the main reasons they use BNPL. Imagine a world of borrowing with no interest rates, fewer maxed out credit cards and better credit scores.

It Improves Customer Experience & Retention

Vagaro Pay Later gives clients more choice and control over their payment options. As a BNPL service, it also offers a simple, straightforward and frictionless payment process. These are the ingredients for an elevated client experience, the kind that keeps them coming back.

Consumers are even more likely to make a purchase if flexible payment options are made part of a seamless point of sale experience.

It Improves Conversion Rates

Flexible BNPL options, like Vagaro Pay Later, can remove the specter of buyer’s remorse from a client’s mind. This means fewer abandoned shopping carts and an increased likelihood that clients will follow through when booking services online. In fact, numbers point to up to a 30% conversion rate on average for businesses with BNPL platforms.

It Increases Average Order Values

Business can lift average order values (AOV) by 30%–50% when they use BNPL over other payment methods, according to CNBC. The lesson: When people know that they can rely on flexible payment options, like Vagaro Pay Later, they are likely to spend more on additional services and package upgrades.

Pro tip: Be sure that you introduce the Vagaro Pay Later option as early in the sales conversation as possible.

How to Get Started with Vagaro Pay Later

Setting up Vagaro Pay Later is straightforward. The VPL approval process for businesses with Vagaro med spa software takes four business days. When approved, existing Vagaro businesses will find the feature in the “Add-Ons” section of their software. They simply select activate, then set their min/max price limits. Now, they can accept VPL payments for everything you sell, including products, services & packages. They also have the flexibility of applying repayment plans to both online and in-house checkouts. New customers who sign up for Vagaro Merchant Services will be enrolled automatically into VPL.

Clients who choose the Pay Later option must also get approved to use it, though this process is fairly quick. To sign up, they simply find the VPL option in their Vagaro profile, accept the terms and conditions and input their bank account information.

Check out this helpful article for more in-depth information on how to set up Vagaro Pay Later.

-----

The use of buy now, pay later has skyrocketed over the last several years, concurrent with the significant growth of the medspa industry. Seamlessly integrated into the rest of the Vagaro software, Vagaro Pay Later will enable medspas to sell more high-value services and increase overall sales conversions with no financial risk to them. Don’t leave so much potential revenue on the table. Start using Vagaro today!